Loan Service Providers: Your Trusted Financial Allies

Loan Service Providers: Your Trusted Financial Allies

Blog Article

Simplify Your Financial Trip With Trusted and Efficient Funding Providers

Trusted and reliable loan services play a pivotal duty in this procedure, offering individuals a reliable path towards their economic objectives. By comprehending the benefits of functioning with respectable loan providers, checking out the different types of loan services available, and sharpening in on vital aspects that establish the ideal fit for your needs, the course to financial empowerment ends up being more clear - mca loans for bad credit.

Advantages of Relied On Lenders

When looking for monetary assistance, the benefits of picking trusted loan providers are paramount for a protected and trustworthy borrowing experience. Trusted loan providers supply openness in their conditions, supplying customers with a clear understanding of their commitments. By dealing with trustworthy loan providers, customers can avoid hidden costs or aggressive methods that could result in economic risks.

In addition, trusted lenders often have actually developed partnerships with regulatory bodies, making sure that they run within lawful boundaries and stick to market standards. This compliance not just protects the customer yet additionally fosters a feeling of count on and reliability in the financing procedure.

Furthermore, reliable lending institutions focus on consumer solution, supplying support and support throughout the borrowing journey. Whether it's making clear loan terms or aiding with repayment alternatives, trusted loan providers are dedicated to aiding consumers make well-informed monetary decisions.

Sorts Of Finance Provider Available

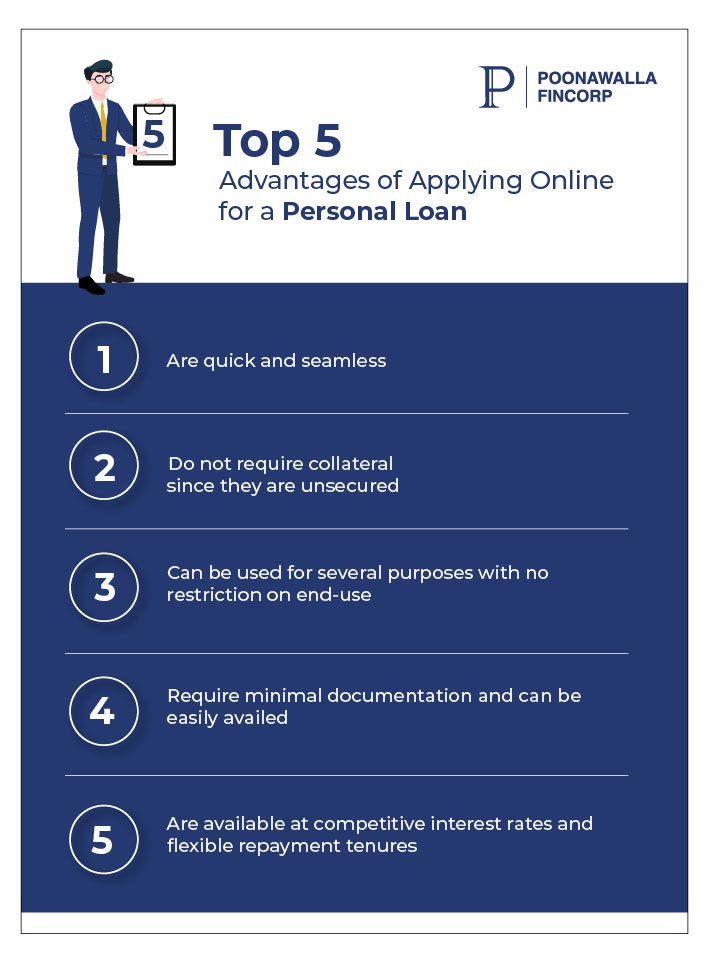

Various financial establishments and lending companies offer a diverse series of loan solutions to deal with the differing requirements of consumers. A few of the common types of lending solutions readily available consist of individual finances, which are generally unprotected and can be made use of for numerous functions such as debt loan consolidation, home restorations, or unforeseen costs. Home loan are specifically designed to aid individuals buy homes by offering substantial amounts of money upfront that are paid back over a prolonged period. For those looking to buy a cars and truck, car lendings supply a means to fund the acquisition with dealt with month-to-month payments. Additionally, service financings are readily available for business owners looking for funding to start or expand their endeavors. Trainee fundings cater to academic expenses, supplying funds for tuition, books, and living expenditures during academic pursuits. Recognizing the various kinds of loan services can aid debtors make informed choices based on their details financial demands and objectives.

Factors for Choosing the Right Loan

Having actually acquainted oneself with the varied variety of car loan services available, borrowers need to diligently examine crucial elements to select one of the most appropriate funding for their particular financial needs and goals. One crucial aspect to think about is the rates of interest, as it directly impacts the complete amount settled over the financing term. Debtors should contrast rate of interest prices from different lenders to secure one of the most competitive alternative. Car loan conditions likewise play a vital duty in decision-making. Understanding the settlement schedule, costs, and penalties linked with the car loan is necessary to avoid any kind of surprises in the future.

Moreover, customers must review their current financial scenario and future leads to identify the finance quantity they can comfortably pay for. By very carefully taking into consideration these variables, borrowers can choose the best finance that straightens with their economic objectives and capabilities.

Streamlining the Car Loan Application Refine

Effectiveness in the loan application process is critical for ensuring a smooth and expedited loaning experience. To enhance the loan application process, it is important to provide clear support to applicants on the called for documentation and information - Loan Service. Utilizing online systems for application entries can significantly reduce the moment and initiative associated with the process. Executing automated systems for verification of documents and credit score checks can accelerate the application evaluation process. Offering pre-qualification alternatives based on standard details supplied by the applicant can aid in straining ineligible candidates early on. Giving routine updates to applicants on the standing of their application can improve transparency and consumer fulfillment. Furthermore, simplifying the language used in application kinds and interaction materials can facilitate much better understanding for applicants. By incorporating these structured processes, loan providers can use a more reliable and user-friendly experience to consumers, ultimately boosting overall client satisfaction and commitment.

Tips for Successful Loan Settlement

Navigating the course to successful lending settlement needs careful preparation and disciplined economic management. To make certain a smooth payment trip, begin by developing a comprehensive spending plan that includes your funding payments. Comprehending your income and costs will certainly assist you allocate the needed funds for timely payments. Take into consideration setting up automated settlements to prevent missing out on deadlines and incurring late costs. It's also recommended to pay even more than the minimum amount due monthly if feasible, as this can help decrease the total rate of interest paid and reduce the settlement period. Prioritize your finance repayments to avoid skipping on any kind of lendings, as this can negatively influence your credit scores rating and economic stability. In case of monetary problems, connect with your lending institution to discover feasible alternatives such as funding restructuring or deferment. By remaining arranged, aggressive, and monetarily disciplined, you can successfully investigate this site navigate the process of repaying your car loans and accomplish higher monetary flexibility.

Final Thought

To conclude, using trusted and reliable financing solutions can significantly simplify your economic trip. By thoroughly selecting the appropriate loan provider and kind of financing, and enhancing the application process, you can make sure a successful loaning experience. Bear in mind to focus on timely settlement to keep monetary stability and construct a positive credit rating. Trustworthy lenders provide valuable assistance to assist you achieve your monetary goals - Financial Assistant.

Report this page